pay indiana state property taxes online

Main Street Crown Point IN 46307 Phone. Main Street Crown Point IN 46307 Phone.

Louisiana Quit Claim Deed Form Quites Louisiana Louisiana Parishes

To levy taxes in Indiana the state legislature must first pass a law not the local government.

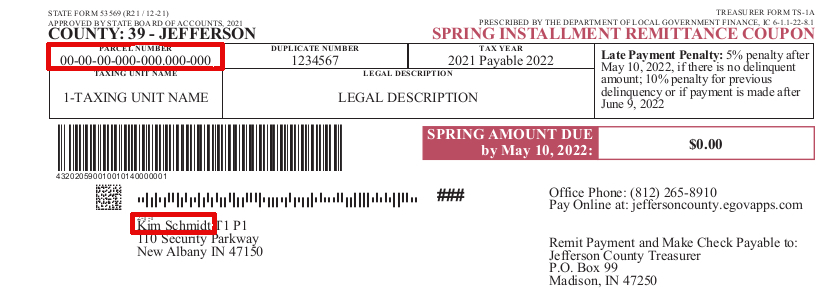

. 4TAX 4829 or 1888 You can pay your property tax by mail. E-Check Visa Mastercard Discover and American Express accepted. Server maintenance was performed and new website software is.

After you make an online. This allows for a wide range of property tax rates in the state. MAIL Remit Payment to Bartholomew County Treasurer PO Box 1986 Columbus IN 47202.

Your browser appears to have cookies disabled. La Porte County Government accepts online payments for Traffic Tickets Probation Fees Property Taxes and more. Personal Property Online Portal - Indiana Indiana Department of Local Government Finance.

Call 317-327-4444 if you have any questions. Know when I will receive my tax refund. How Do I Pay My Indiana Property Taxes.

You can pay your property tax over the phone by calling 317327. Find Indiana tax forms. Enter your parcel number name or street name to view your invoice.

Please direct all questions and form requests to the above agency. Cookies are required to use this site. File my taxes as an Indiana resident while I am in the military but my spouse is not an Indiana resident.

Building A 2nd Floor 2293 N. Credit and debit card transactions will incur a convenience fee of 235 of your total tax liability. Indianapolis Marion County Payment Portal.

Call 855-423-9335 with questions. Postmarked by due date to be considered on time 2. In Indiana aircraft are subject to.

20 N 3rd Street. Online Payments - Visa MasterCard American Express or Discover credit cards debit cards. Quick Links 2022 Primary Election DEPARTMENT PHONE LIST Employment Opportunities Pay Traffic Citation Pay Court Fines and Fees Warrant Search Court Date Lookup Pay Property Tax.

Use an e-Check or credit card to make a payment. The Indiana Department of Revenue does not handle property taxes. The Marion County Assessors Office locates identifies and appraises all taxable property accurately uniformly and equitably.

Indiana Sales Tax Small Business Guide Truic

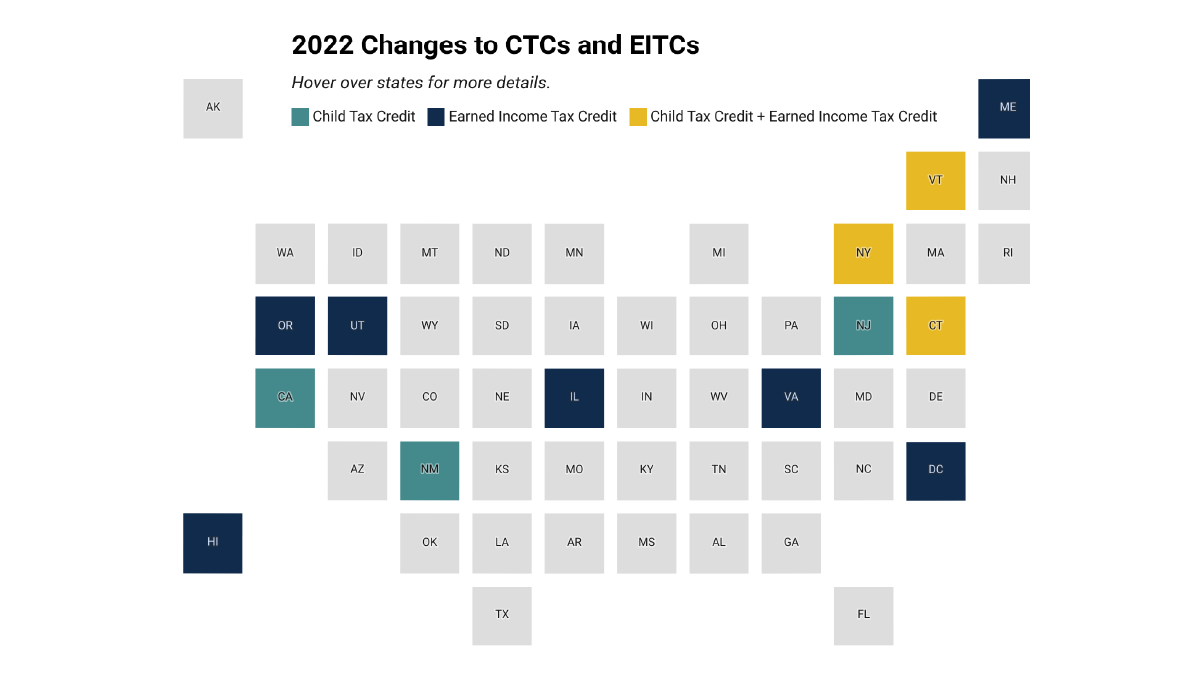

Legislative Momentum In 2022 New And Expanded Child Tax Credits And Eitcs Itep

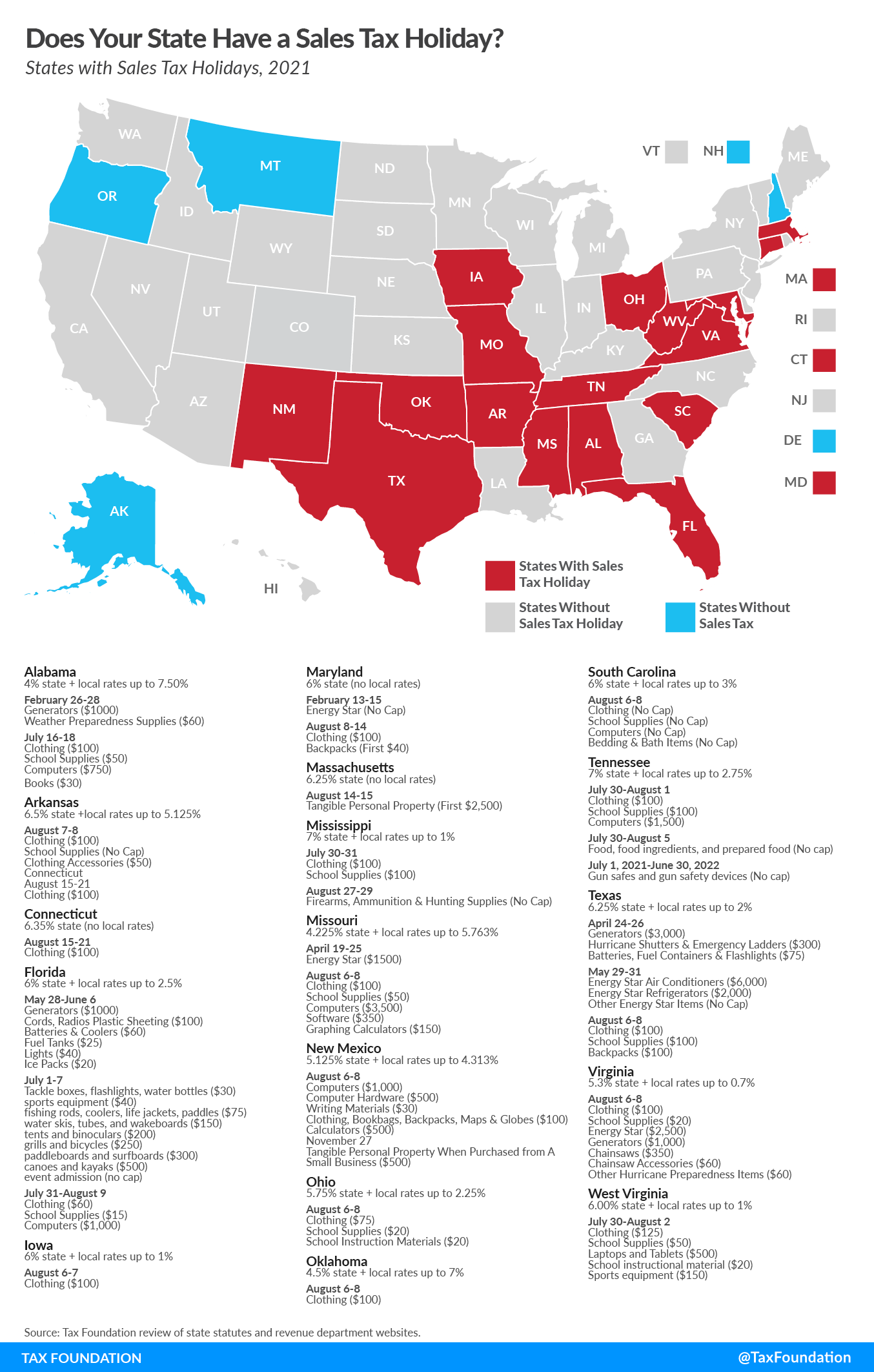

Sales Tax Holidays Politically Expedient But Poor Tax Policy

Is Indiana Tax Friendly Where Hoosier State Ranks Nationally

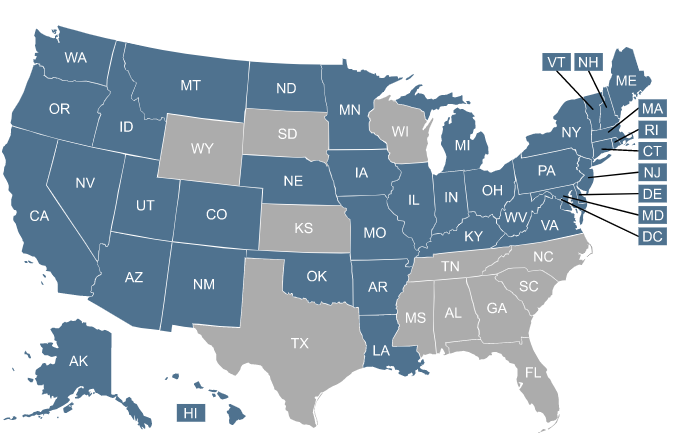

Medicaid Expansion Eligibility Enrollment And Benefits In Your State

New Flavor How Hops Are Growing In North Carolina North Carolina Agriculture New Flavour

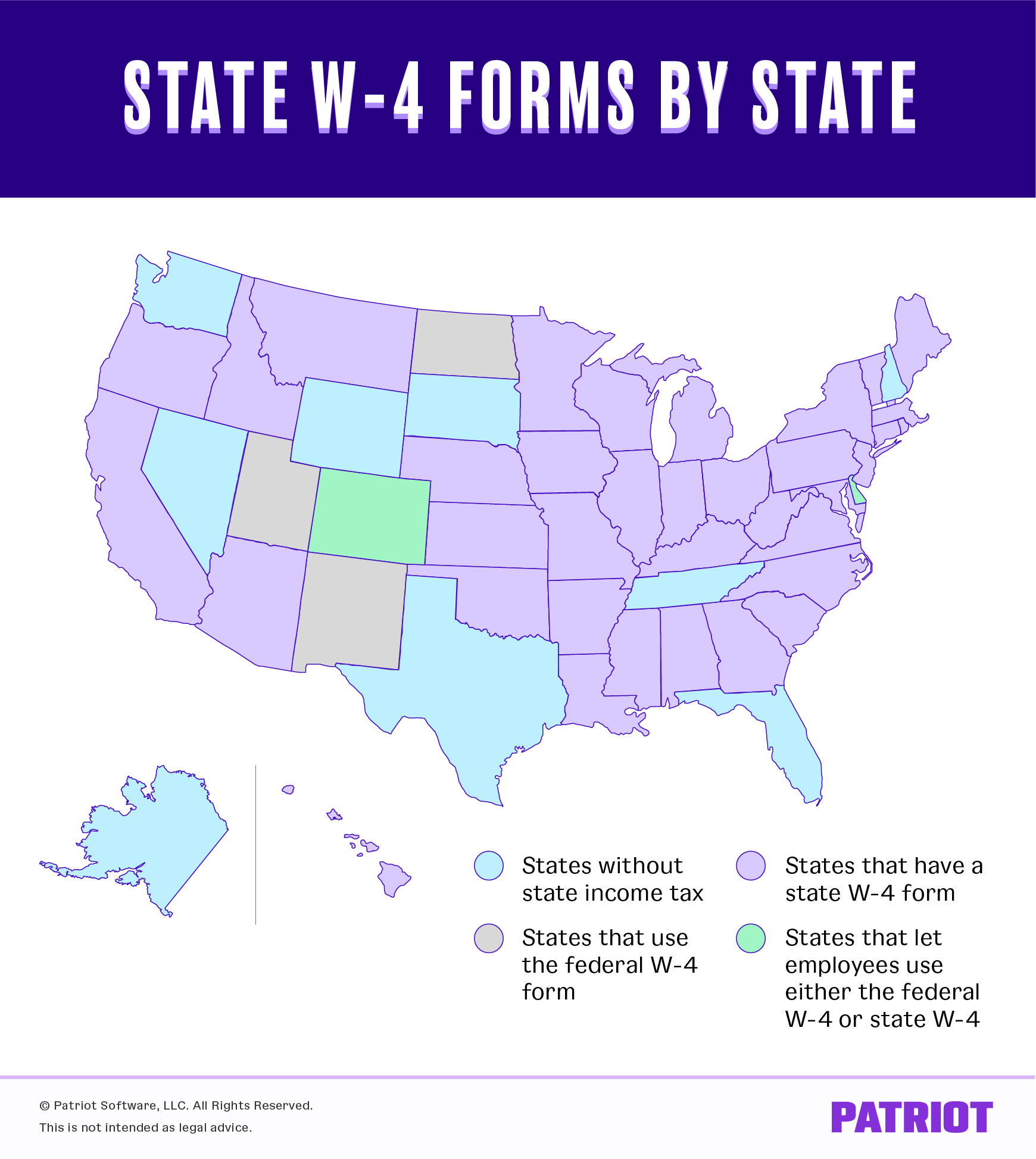

State W 4 Form Detailed Withholding Forms By State Chart

Dor Owe State Taxes Here Are Your Payment Options

No Fresh Start In 2021 Will States Let Debt Collectors Push Families Into Poverty As Pandemic Protections Expire Web Version National Consumer Law Center

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

Treasurer Franklin County Indiana

Little Known Veteran Benefit Eliminates Up To 15 Years Of Mortgage Payments Pay Off Mortgage Early Mortgage Payoff Refinance Mortgage

Ucc 1 Traveling Rights And Understanding Common Law Good Morals Prejudice